This article was published on February 25, 2019 on Employee Benefit Adviser written by Kayla Webster.

Younger generations are often characterized as entitled and demanding — but that self-confidence in their work is pushing companies to adopt benefits outside the traditional healthcare and retirement packages.

By 2025, millennials will make up 75% of the U.S. workforce, according to a study by Forbes. The first wave of Generation Z — millennials’ younger siblings — graduated college and entered the workforce last year. With these younger generations flooding the workplace, benefit advisers need to steer clients toward innovative benefits to attract and retain talent, according to panelists during a lifestyle benefits discussion at Workplace Benefits Renaissance, a broker convention hosted by Employee Benefit Adviser.

“Millennials came into the workforce with a level of entitlement — which is actually a good thing,” said Lindsay Ryan Bailey, founder and CEO of Fitpros, during the panel discussion. “They’re bringing their outside life into the workplace because they value being a well-rounded person.”

Catering benefits to younger generations doesn’t necessarily exclude the older ones, the panelists said, in a discussion led by Employee Benefit Adviser Associate Editor Caroline Hroncich. Older generations are accustomed to receiving traditional benefits, but that doesn’t mean they won’t appreciate new ones introduced by younger generations.

“Baby boomers put their heads down and get stuff done without asking for more — that’s just how they’ve always done things,” Bailey said. “But they see what millennials are getting and are demanding the same.”

In a job market where there are more vacant positions than available talent to fill them, the panelists said it’s important now, more than ever, to advise clients to pursue lifestyle benefits. While a comprehensive medical and retirement package is attractive, benefits that help employees live a more balanced life will attract and retain the best employees, the panelists said.

“Once you’ve taken care of their basic needs, have clients look at [lifestyle benefits],” said Dave Freedman, general manager of group plans at LegalZoom. “These benefits demonstrate to workers that the employer has their back.”

The most attractive lifestyle benefits are wellness centered, the panelists said. Wellness benefits include everything from gym memberships, maternity and paternity leave, flexible hours and experiences like acupuncture and facials. But no matter which program employers decide to offer, if it’s not easily accessible, employees won’t use it, the panel said.

“Traditional gym memberships can be a nightmare with all the paperwork,” said Paul O’Reilly-Hyland, CEO and founder of Zeamo, a digital company connecting users with gym memberships. “[Younger employees] want easy access and choices — they don’t want to be locked into contracts.

Freedman said brokers should suggest clients offer benefits catered to people based on life stages. He says there are four distinct stages: Starting out, planting roots, career growth and retirement. Providing benefits that help entry level employees pay down student debt, buy their first car or rent their first apartment will give companies access to the best new talent.

To retain older employees, Freedman suggests offering programs to help employees buy their first house, in addition to offering time off to bond with their child when they start having families. The career growth phase is when most divorces happen and kids start going to college, Freedman said. Offering legal and financial planning services can help reduce employee burdens in these situations. And, of course, offering a comprehensive retirement plan is a great incentive for employees to stay with a company, Freedman said.

Clients may balk at the additional costs of implementing lifestyle benefits, but they help safeguard against low employee morale and job turnover. Replacing existing employees can cost companies significant amounts of money, the panelists said.

“Offering these benefits is a soft dollar investment,” Freedman said. “Studies show it helps companies save money, but employers have to be in the mind-set that this is the right thing to do.”

Nearly two in five surveyed organizations (38%) have budgets specifically devoted to benefits communication, and one-quarter of these organizations (25%) likely will increase their budgets next year. A few organizations shared the size of their benefits communications budgets, which ranged from 3% to 10% of the total benefits budget.

Nearly two in five surveyed organizations (38%) have budgets specifically devoted to benefits communication, and one-quarter of these organizations (25%) likely will increase their budgets next year. A few organizations shared the size of their benefits communications budgets, which ranged from 3% to 10% of the total benefits budget. Survey findings reveal that 65% of organizations regard benefits communication as a high priority (28% very high and 36% somewhat high). However, the amount of time spent on various benefits communication efforts doesn’t always match up with organizations’ priorities. For example, 89% of organizations report helping participants understand and use their benefits as a top goal, but only 70% say that effort occupies most of their time. Fifty-two percent cite getting individuals to understand the value of benefits as a top goal, but 48% say it takes most of their time. Helping participants make smarter personal health and/or finance decisions is the third most cited goal (49%), with 30% saying it occupies most of their time. Data show how reactively responding to participant questions (57%) seems to be stealing time from organizations’ more proactive benefits communication goals.

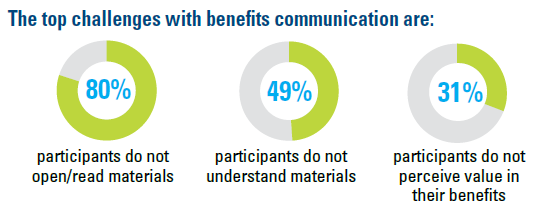

Survey findings reveal that 65% of organizations regard benefits communication as a high priority (28% very high and 36% somewhat high). However, the amount of time spent on various benefits communication efforts doesn’t always match up with organizations’ priorities. For example, 89% of organizations report helping participants understand and use their benefits as a top goal, but only 70% say that effort occupies most of their time. Fifty-two percent cite getting individuals to understand the value of benefits as a top goal, but 48% say it takes most of their time. Helping participants make smarter personal health and/or finance decisions is the third most cited goal (49%), with 30% saying it occupies most of their time. Data show how reactively responding to participant questions (57%) seems to be stealing time from organizations’ more proactive benefits communication goals. Each of the top challenges with benefits communication is centered on participants: Participants do not open/read materials (80%), don’t understand materials (49%) and do not perceive value in their benefits (31%). (Each is cited far more frequently than internal challenges such as benefits staff time, resources or expertise.) Large organizations are more likely to say participants not opening/reading communication materials is a top challenge. U.S. organizations are far more likely to view complying with mandated benefits communication as a top goal, challenge and consumer of time, compared with Canadian organizations.

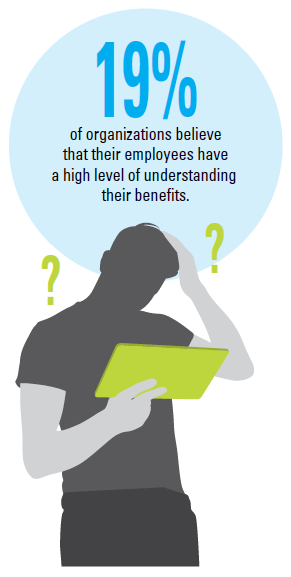

Each of the top challenges with benefits communication is centered on participants: Participants do not open/read materials (80%), don’t understand materials (49%) and do not perceive value in their benefits (31%). (Each is cited far more frequently than internal challenges such as benefits staff time, resources or expertise.) Large organizations are more likely to say participants not opening/reading communication materials is a top challenge. U.S. organizations are far more likely to view complying with mandated benefits communication as a top goal, challenge and consumer of time, compared with Canadian organizations. Few organizations believe their participants have a very high (3%) or somewhat high (16%) level of benefits understanding. Half (49%) say the number of participant questions regarding benefits has increased in the past two years, compared with just 7% reporting a decrease in questions. U.S. organizations are more likely to say the number of participant benefit questions has increased in the last two years compared with those from Canada. Some of the most common benefits topics about which organizations receive participant questions are the Affordable Care Act, health reimbursement arrangements and health savings accounts, plan design changes, accessing retirement funds and health care eligibility, coverage and costs.

Few organizations believe their participants have a very high (3%) or somewhat high (16%) level of benefits understanding. Half (49%) say the number of participant questions regarding benefits has increased in the past two years, compared with just 7% reporting a decrease in questions. U.S. organizations are more likely to say the number of participant benefit questions has increased in the last two years compared with those from Canada. Some of the most common benefits topics about which organizations receive participant questions are the Affordable Care Act, health reimbursement arrangements and health savings accounts, plan design changes, accessing retirement funds and health care eligibility, coverage and costs.

Meet Marilyn. Also 55, she is divorced, has younger dependent children and is not ready to retire.

Meet Marilyn. Also 55, she is divorced, has younger dependent children and is not ready to retire.