The below article was posted by the International Foundation of Employee Benefit Plans on October 27, 2016 and was written by Kathy Bergstrom, CEBS.

Tailoring pension and benefits messages by age or generation is a good first step toward helping plan members make better decisions. But that may not go far enough. “An evolution is coming to more personalized retirement and benefit plan communications,” said Michelle Oram, CEBS, director of product development at Manulife in Waterloo, Ontario. Oram made the remarks during her presentation “Financial Education—Let’s Get Personal” at the 35th Annual ISCEBS Employee Benefits Symposium in September in Baltimore, Maryland.

“Now we segment communications based on age or generation. It’s a step in the right direction, but painting everyone with four little brushes still generalizes,” she said. The pitfall is that messages are based on assumptions rather than behavioral data. “Employee needs are more about personal circumstances than age.”

Oram gave an example of two 55-year-olds who, even though they’re the same age, have different life situations and financial priorities.

Meet Dave. He is 55, is married, has grown children and thinks about retirement a lot.

Dave’s financial priorities: maintaining his lifestyle in retirement, saving for retirement and saving for his family’s future.

What Dave needs: retirement lifestyle coaching, retirement income projections, retirement planning advice and estate planning support.

Key message for Dave: Deposit his regular bonus into his RRSP.

Meet Marilyn. Also 55, she is divorced, has younger dependent children and is not ready to retire.

Meet Marilyn. Also 55, she is divorced, has younger dependent children and is not ready to retire.

Marilyn’s financial priorities: paying for her kids’ education, saving for retirement and reducing debt.

What Marilyn needs: retirement income projections, tips to get on track and a financial wellness program that includes debt management.

Key message for Marilyn: Increase her regular contribution to her retirement plan.

But how does a plan sponsor figure this out without invading someone’s privacy? Data, Oram said, and plan sponsors and administrators already have a lot of it.

They have basic demographic information such as the age and gender of their employees. They also have information on life events from plan enrollment such as when someone gets married or divorced or has a child.

They have employment data such as job title, salary and promotions, and they have behavioral data from retirement plans such as investment selections and whether employees maximize the employer match.

With that data in hand, plans should identify key messages and actions. For example, they can look at who doesn’t take full advantage of the match and create a personalized message motivating them to up their contributions.

They can look at who has deposited bonuses in the past and craft an e-mail encouraging those employees to do so again.

Messages must be personal, however, to catch employees’ attention, she said.

Strategies that work include e-mails with a meaningful sender name and subject line and with a link to a personalized video or URL outlining the impact the desired behaviour will have on the employee’s retirement plan.

“Benefits communications are competing with a lot of personalized messages your employees see every day,” Oram said.

Health and wellness are integral to employee performance, which helps explain why employers are investing more in their employee benefit offerings.

Health and wellness are integral to employee performance, which helps explain why employers are investing more in their employee benefit offerings.

The new year is a good time to look at the benefits larger companies are using to attract and retain good people. According to their 2017 Employee Benefits report, the Society for Human Resource Management tells us that HSAs, wholesale generic drug programs for injectable drugs, standing desks and genetic testing for chronic diseases are becoming popular. The report shows that 55% of businesses allow those with high deductible health plans to put part of their pay into an HSA tax free. This is up from 42% just a few years ago. 36% of employers now also contribute to workers’ HSAs. The percentage of employers covering genetic testing rose from 12% to 18% in just one year.

The new year is a good time to look at the benefits larger companies are using to attract and retain good people. According to their 2017 Employee Benefits report, the Society for Human Resource Management tells us that HSAs, wholesale generic drug programs for injectable drugs, standing desks and genetic testing for chronic diseases are becoming popular. The report shows that 55% of businesses allow those with high deductible health plans to put part of their pay into an HSA tax free. This is up from 42% just a few years ago. 36% of employers now also contribute to workers’ HSAs. The percentage of employers covering genetic testing rose from 12% to 18% in just one year.

Nearly two in five surveyed organizations (38%) have budgets specifically devoted to benefits communication, and one-quarter of these organizations (25%) likely will increase their budgets next year. A few organizations shared the size of their benefits communications budgets, which ranged from 3% to 10% of the total benefits budget.

Nearly two in five surveyed organizations (38%) have budgets specifically devoted to benefits communication, and one-quarter of these organizations (25%) likely will increase their budgets next year. A few organizations shared the size of their benefits communications budgets, which ranged from 3% to 10% of the total benefits budget. Survey findings reveal that 65% of organizations regard benefits communication as a high priority (28% very high and 36% somewhat high). However, the amount of time spent on various benefits communication efforts doesn’t always match up with organizations’ priorities. For example, 89% of organizations report helping participants understand and use their benefits as a top goal, but only 70% say that effort occupies most of their time. Fifty-two percent cite getting individuals to understand the value of benefits as a top goal, but 48% say it takes most of their time. Helping participants make smarter personal health and/or finance decisions is the third most cited goal (49%), with 30% saying it occupies most of their time. Data show how reactively responding to participant questions (57%) seems to be stealing time from organizations’ more proactive benefits communication goals.

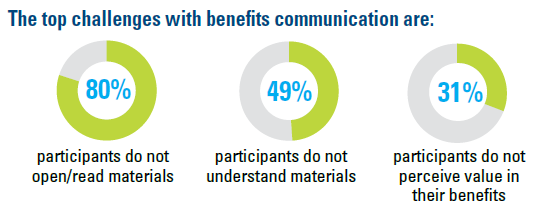

Survey findings reveal that 65% of organizations regard benefits communication as a high priority (28% very high and 36% somewhat high). However, the amount of time spent on various benefits communication efforts doesn’t always match up with organizations’ priorities. For example, 89% of organizations report helping participants understand and use their benefits as a top goal, but only 70% say that effort occupies most of their time. Fifty-two percent cite getting individuals to understand the value of benefits as a top goal, but 48% say it takes most of their time. Helping participants make smarter personal health and/or finance decisions is the third most cited goal (49%), with 30% saying it occupies most of their time. Data show how reactively responding to participant questions (57%) seems to be stealing time from organizations’ more proactive benefits communication goals. Each of the top challenges with benefits communication is centered on participants: Participants do not open/read materials (80%), don’t understand materials (49%) and do not perceive value in their benefits (31%). (Each is cited far more frequently than internal challenges such as benefits staff time, resources or expertise.) Large organizations are more likely to say participants not opening/reading communication materials is a top challenge. U.S. organizations are far more likely to view complying with mandated benefits communication as a top goal, challenge and consumer of time, compared with Canadian organizations.

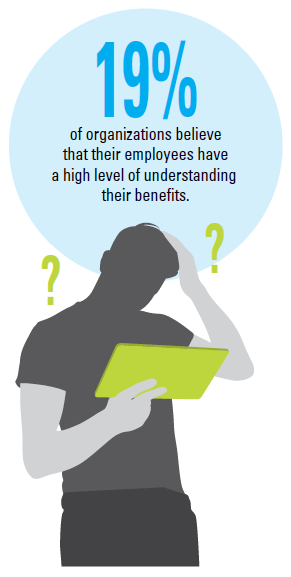

Each of the top challenges with benefits communication is centered on participants: Participants do not open/read materials (80%), don’t understand materials (49%) and do not perceive value in their benefits (31%). (Each is cited far more frequently than internal challenges such as benefits staff time, resources or expertise.) Large organizations are more likely to say participants not opening/reading communication materials is a top challenge. U.S. organizations are far more likely to view complying with mandated benefits communication as a top goal, challenge and consumer of time, compared with Canadian organizations. Few organizations believe their participants have a very high (3%) or somewhat high (16%) level of benefits understanding. Half (49%) say the number of participant questions regarding benefits has increased in the past two years, compared with just 7% reporting a decrease in questions. U.S. organizations are more likely to say the number of participant benefit questions has increased in the last two years compared with those from Canada. Some of the most common benefits topics about which organizations receive participant questions are the Affordable Care Act, health reimbursement arrangements and health savings accounts, plan design changes, accessing retirement funds and health care eligibility, coverage and costs.

Few organizations believe their participants have a very high (3%) or somewhat high (16%) level of benefits understanding. Half (49%) say the number of participant questions regarding benefits has increased in the past two years, compared with just 7% reporting a decrease in questions. U.S. organizations are more likely to say the number of participant benefit questions has increased in the last two years compared with those from Canada. Some of the most common benefits topics about which organizations receive participant questions are the Affordable Care Act, health reimbursement arrangements and health savings accounts, plan design changes, accessing retirement funds and health care eligibility, coverage and costs.

Meet Marilyn. Also 55, she is divorced, has younger dependent children and is not ready to retire.

Meet Marilyn. Also 55, she is divorced, has younger dependent children and is not ready to retire.